The value of the global soft drinks market increased by less than 2% in 2013 to US$937 billion, but the Red Bull energy drink and key Chinese brands, such as Kangshifu, are making their mark, according to Canadean’s latest data from its online Wisdom Analytics database.

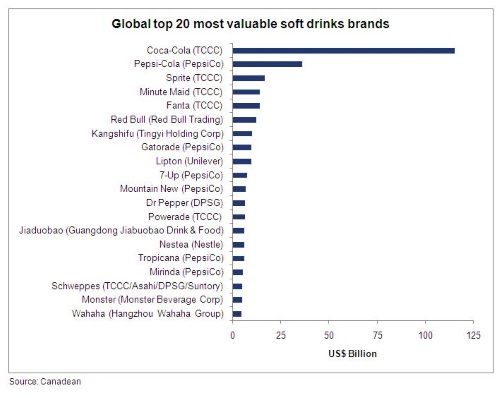

The speed at which major Chinese brands are achieving top global value status is highlighted in Canadean’s chart of the top 20 most valuable soft drinks brands.

In 2008 only Kangshifu (Tingyi Holding Corp.) made the grade, ranking sixteenth.

The intervening years to 2013 have seen the brand jump to number seven, representing an annual average growth rate of 19% versus a global average of 4%.

In 2013 Canadean estimates that the Kangshifu brand attained a value approaching US$10 billion.

Just ahead of Kangshifu in sixth position, the strength of the Red Bull energy drink in on-premise and ‘on the go’ channels, and ability to withstand the impact of even some of the worst hit country economies in recent years, underlies consumer willingness to pay for a perceived image and personal benefit.

The market research company says Red Bull has recorded an annual average growth in value of 7% since 2008 to reach US$12 billion in 2013.

Of the other Chinese brands, herbal drink manufacturer Jiaduobao (Guangdong Jiaduobao Drink & Food Co), joined the top 20 line-up in 2012, rising two places to number fourteen in 2013.

China’s domestic soft drinks company Hangzhou Wahaha Group saw its brand make the leading 20 in 2013, despite a slowdown in overall brand volume growth as the company sought to diversify its business into other industries.

A look at the top end of the global top 20 most valuable soft drinks ranking for 2013 reveals no surprises, with the Coca-Cola brand in pole position, followed by Pepsi-Cola on the strength of their global reach.

Both trademarks saw a rise in value of only around 1% in 2013, as growth in the international markets was tempered by a sharp contraction in sales in the US.

Amongst the other Coca-Cola company brands within the global top 20 listing, the most successful in value growth terms was Minute Maid, supported by a strong performance in Asia – and more specifically China and Japan.

Within the ranking, PepsiCo’s most upbeat performance with regards to incremental value came from its Mirinda carbonate, benefiting from the company’s investment in promotional activity in 2013 in China.

Meanwhile Monster energy drinks’ (Monster Beverage Corp) rising star saw it take a step up the value ladder in 2013, supported by its evolving range of products and flavors.

With the recent announcement of Coca-Cola’s acquisition of a stake in Monster Beverage Corp, analyst Antonella Reda said “how the expansion of distribution through the Coca-Cola system can further Monster’s value share will be one to watch.”